Buyer Sentiment

According to Fannie Mae Home Purchase Sentiment Index (HPSI), a greater number of people are feeling more confident that it is a good time to buy a home. In December the HPSI had increased by 3.7 points, although overall is still low at 61.0. However, is this an early trend showing buyers are coming back to the market? In a previous blog, I noted how mortgage applications had significantly increased, as did requests for pre-approvals. This is good news for a market rebound. So what is driving this apparent and potential rebound? As we noted, interest rates are stabilizing and are projected to continue its downward projection into spring, hopefully stabilizing in the 4-5% range. We are seeing home buyer demand increase now, and supply is still on the low side, this supply-demand relationship will keep home values stable to slower continued appreciation depending on your area.

More People Believe It’s a Good Time to Buy

Redfin reports there are early indicators of improving homebuying sentiment — both home tour requests and mortgage purchase applications have increased since October. Home Purchase sentiment was down to around 16% at its lowest and has now risen to 21% of people responding believe it is a good time to buy. This is indeed still quite low, but it is showing a positive direction due to the aforementioned conditions above. With rate down, this is also making homes more affordable for home buyers.

Will This Home Buyer Recovery Spell Trouble for Buyers?

We all have fresh in our minds the last year in a half. Home values were driven up so dramatically due to extremely low supply coupled with extremely high buyer demand. This set us up for multiple offer scenarios on almost every transaction. Too many buyers for the little number of homes out there. This was a huge problem for many homebuyers, many were first time homebuyer that just could not compete with the bidding of 30, 40, 50, sometimes 100K over asking price with large down payments, appraisal waivers, etc. This was a very difficult time to be a home buyer, and in particular a first-time buyer. Firs time home buyers more often did not have the financial ability to bid up homes to this degree, waive inspections, waive appraisals, and have the additional funds to offer large appraisal gap coverages which really became the norm of the past year or so. So, the question buyers should be asking themselves is “are we heading back to a similar situation?” I am not sure either way, but there are some indications this could happen. More than likely, it would not happen to the same extent…. hopefully.

Should Potential Home Buyers Return to the Market Now?

This is an interesting question. Do you continue to wait and see if home prices drop? As I mentioned and showed data on a previous blog, this seems to be a favorable time to buy. As we see from the data, there are not as many buyers out there which equals LESS COMPETITION. Less competition will help you get a more favorable price on the home you are looking to purchase. In addition, home values are likely to stay pretty flat, and interest rates are coming down. As I also mentioned in a previous blog, when people hear the word recession, they may think that home prices are likely to decline. But history shows us that home values have done very well during and after 8 of the past 9 recessions. In fact, recessions have often proven to be a good buying opportunity.

Lets Have a Look at Some More Data

Inflation Turning the Corner

The Fed’s favorite measure of inflation, Personal Consumption Expenditures (PCE), showed that headline inflation rose 0.1% in December, while the year-over-year reading declined from 5.5% to 5%. Core PCE, which strips out volatile food and energy prices, rose by 0.3% with the year-over-year change falling from 4.7% to 4.4%.

Bottom line? Headline PCE has declined nearly 2% after peaking last June, while Core PCE is down 1% after reaching 5.4% last February. This is a meaningful improvement in inflation, and the decline is expected to continue. Inflation is calculated on a rolling 12-month basis, so the total of the past 12 monthly inflation readings gives us the year-over-year rate of inflation. Readings from the start of last year are higher comparisons, so if we continue to see lower monthly inflation readings, the annual rate of inflation will continue to move lower.

Pending Home Sales Rise for First Time in Six Months

-1-27-2023.png?version=8)

Pending Home Sales rose 2.5% from November to December, ending sixth straight months of declines. However, sales were 33.8% lower than they were a year earlier. This is a critical report for taking the pulse of the housing market, as it measures signed contracts on existing homes, which represent around 90% of the market.

Bottom line? Lawrence Yun, chief economist for the National Association of Realtors, noted, “This recent low point in home sales activity is likely over. Mortgage rates are the dominant factor driving home sales, and recent declines in rates are clearly helping to stabilize the market.”

New Home Sales Ticked Higher in December

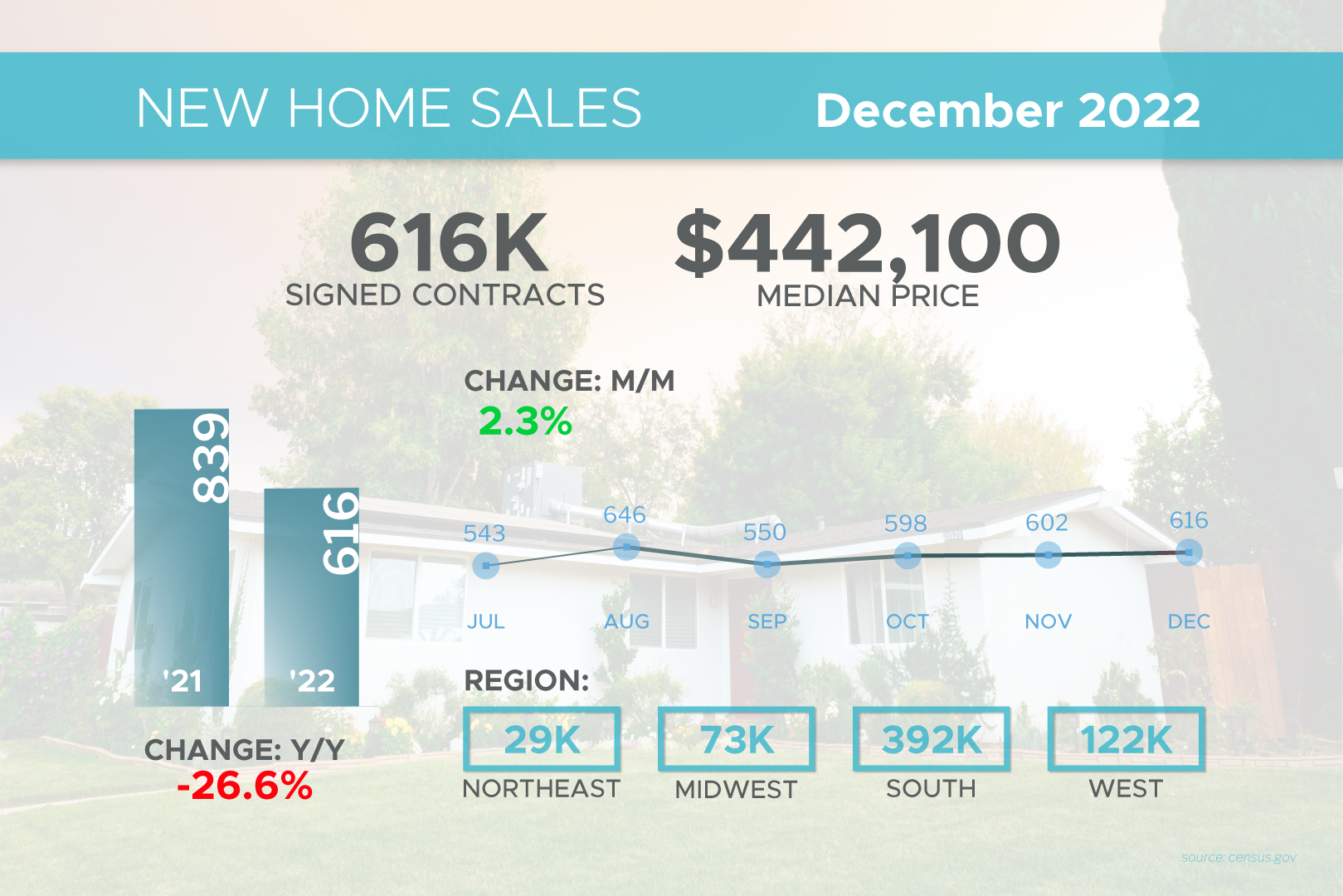

New Home Sales rose 2.3% in December to a 616,000-unit annualized pace, which was in line with estimates.

Bottom line? December saw a slight decline in mortgage rates, so it makes sense that buyer activity moved higher. And while the median price for new homes fell from $459,000 in November to $442,100 in December, this is not the same as a decline in home prices. The median price simply means half the homes sold were above that price and half were below it, and this figure can be skewed by the mix of sales among lower-priced and higher-priced homes.

Looking closely at inventory, there were 461,000 new homes for sale at the end of December, which equates to a 9 months’ supply. However, only 71,000 were completed, with the rest either not started or under construction. The number of completed homes equates to a 1.4 months’ supply. This is well below a balanced market and showing inventory remains tight.

Economic Slowdown and Recession Signs Continue

Several reports released last week continue to show that the economy is slowing. The National Association for Business Economics released their January 2023 Business Conditions Survey of 60 of its members firms. The responses showed that profit margins remain under pressure. In addition, hiring plans turned negative for the first time since the pandemic. Just over half of respondents felt there was a 50% or higher chance of a recession over the next year.

We are also continuing to see inversions on the yield curve, with 1-month, 3-month, 1-year and 2-year yields all moving higher than 10-year yields. This is unusual as typically you would expect to receive a higher rate of return if you put your money away for 10 years when compared to lesser timeframes. An upside-down yield curve has been a historically accurate recession indicator, as it is a symptom that the economy is slowing.

Bottom line? The economy has been slowing in large part because of aggressive action taken by the Fed last year to try to tame runaway inflation, including seven hikes to its benchmark Fed Funds Rate. This is the overnight borrowing rate for banks, and it is not the same as mortgage rates. Raising the cost of borrowing on certain items slows the economy down and incentivizes savings rates, driving down demand and thus curbing inflation, which has begun to cool per recent reports.

So What Is The Bottom Line For YOU?

The answer is going to be different for each person’s situation. However, if there a home out there right now that you absolutely love, but you are afraid of the “market”, call us so we can evaluate your particular situation. In Livingston County the projections are for homes to continue to appreciate, albeit at a much slower rate. With less competition out there right now, and interest rates down, this seems to be a strategic time to be in the market to buy a home. It may cost you more to wait! The last thing you want is to wait to spring, and there is even more buyer demand and now we’re back in a situation where the competition is so significant that it prevents many from getting into their dream homes. Or waiting another year or two and finding that home values are even higher, and now you can afford even less…

What Should You Do?

Call your local real estate expert at Scott Realty Group. We would be happy to assess your specific situation and help determine if this is the right time for you to buy a new home or sell your existing home!

Cheers!

Scott Realty Group