Are we looking at an Economic Recession in 2023?

Based on current economic conditions, as well as historical indicators, we will be in a recession in 2023. Most experts are predicting this recession to be quite mild compared to previous ones in history. According to Greg McBride, Chief Financial Analyst at Bankrate…

“Two-in-three economists are forecasting a recession in 2023..”

But what does this mean for the housing market? Does a general recession in the economy also mean falling home prices? These are good questions to ask particularly if you are looking at purchasing or selling a home in 2023. The best way to answer these questions is to look at historical data. So, what does history tell us about the housing market during a recession?

A Recession Doesn’t Necessarily Mean Falling Home Prices

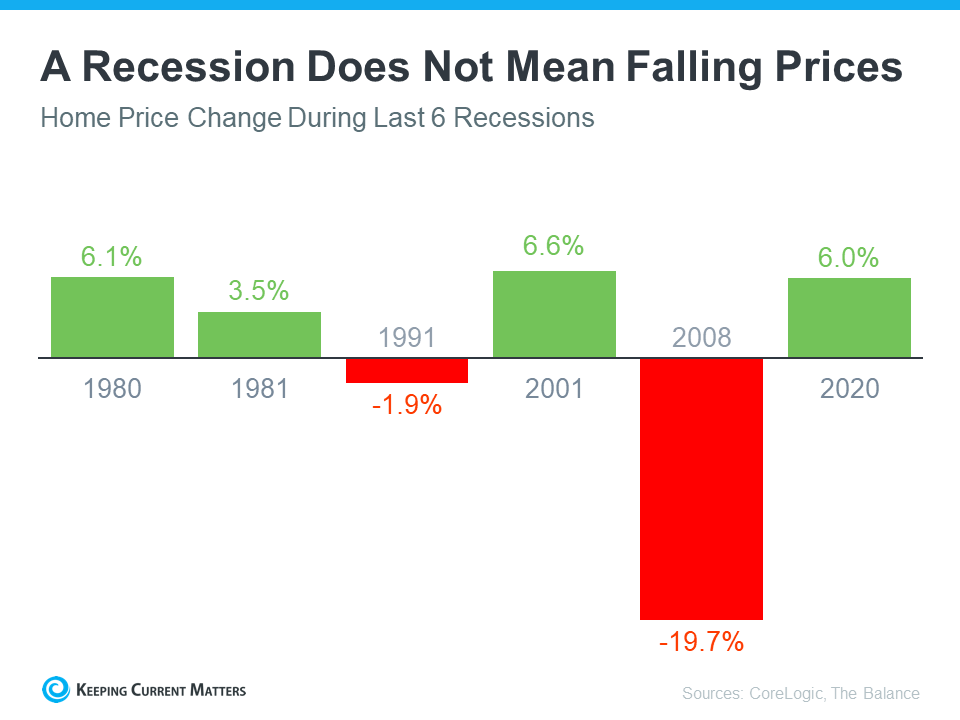

Since 1980, there have been 6 recessions. As you can see from the chart below, four out of the last six recessions, home values actually continued to appreciate. The only major exception to this was 2008. Even in 1991, home values stayed relatively stable and only dropped a net 0f 1.9% nationwide. As we are all aware, there were many factors in 2008 that contributed to the housing market crisis, particularly in the lending mortgage industry.

The Housing Market is NOT about to Crash

The housing market fundamentals are much different in today’s market than in the 2008 market crash. Many may be thinking back to recent history because it is in recent memory of 2008 and thinking that the housing market is going to crash. However, based on data, history, and expert predictions this doesn’t seem to be at all likely. Most experts believe that home prices will vary by market and may go up or down depending on the local area. The 2023 forecasts shows prices will net neutral nationwide and will not fall drastically like they did in 2008 market crisis.

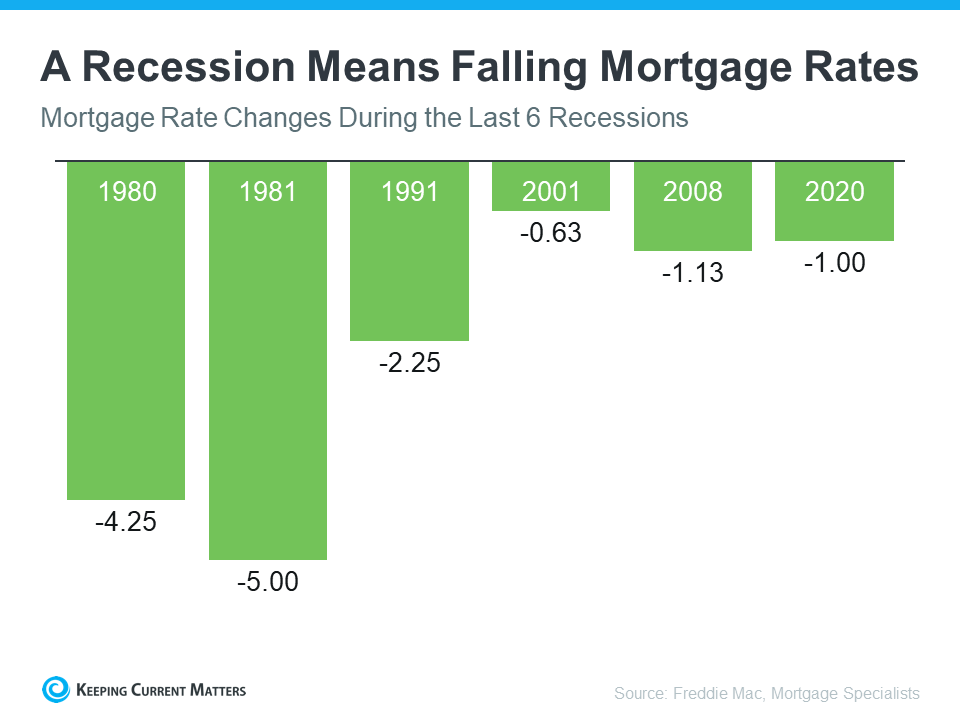

Mortgage Rates Fall During a Recession

Historically, we do see mortgage rate fall during a recession. We also see mortgage rates trend WITH inflation. As inflation lowers, mortgages rates will follow. Take a look at the chart below which shows the last 6 recessions, and where mortgage rates went during each.

What is the Bottom Line?

We should not fear the word recession when it comes to housing market in general. In fact, many experts are predicting recession will be mild and housing market will play a fundamental role in a quick economic rebound. So, in conclusion, while history may not always repeat itself, we have a lot that we can learn from past data, and according to historical data, in most recessions, we see home values appreciate and mortgage rates decline.

So, if you are waiting on the sidelines because you are fearing the housing market and a potential housing market crash, take a look at past history, and you may have more to lose waiting on the sidelines. As I wrote and shared in my previous blog post, based on historical and forecasted data, Livingston county housing market is expected to continue to see appreciation over the next 10 years! So stop waiting on the sidelines, and get out there and find your new dream home! But don’t forget to contact your local experts at Scott Realty Group. Having an experienced real estate professional at your side to find you the best deals and negotiate the best prices is the best thing you can do.

Cheers!

Scott Realty Group